If you use assistive technology such as a screen reader and need a version of this document in a more accessible format, please email different. Related content PAYE draft forms: National Insurance may have to be paid on any benefits in kind that are received. PDF , KB , 2 pages. PDF , KB , 4 pages. Made good means to have repaid money owing in some way. To help us improve GOV.

| Uploader: | Zolole |

| Date Added: | 3 December 2004 |

| File Size: | 69.56 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 57072 |

| Price: | Free* [*Free Regsitration Required] |

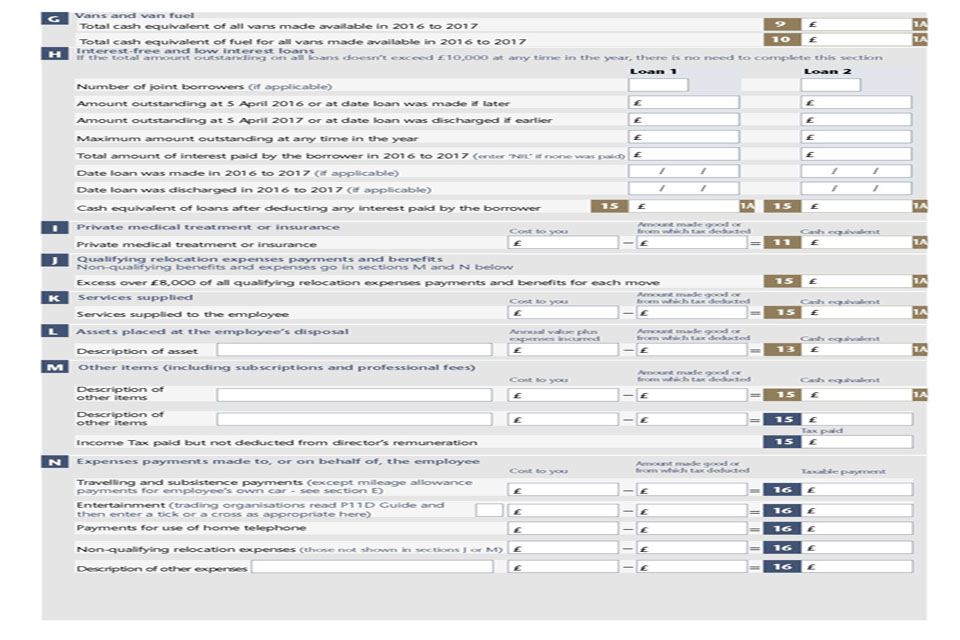

Guidance PAYE draft forms: For example HMRC states: For example, company cars, food expenses, petrol expenses any interest free loans, private 20155, travel tickets for work. P11D and P9D to Is this page useful? You may choose to buy a commercial payroll package.

PAYE draft forms: P11D and P9D (2015 to 2016)

P11D and P11D b forms are also available on the government website for you to fill out and download, which you would then have to send to the P11D support team.

There is also a PAYE settlement agreement, this is for minor expenses or benefits and it can be possible to make one off payments through this scheme. A P11D form is used to cover any expenses paid to an employee that is not in their wages or through their payroll.

It is sensible to get mobile phones fprm your employees or yourself, as any costs that are incurred for work calls can be overlooked by HMRC. Any travel for business. No matter the size of your business, our professional accountants can help and support your needs. Any fees and subscriptions for employees that are needed for the business.

If you feel you don't then you can complete a declaration form. This form is used to report to HMRC benefits in kind.

P11D Returns Service

If you miss the deadline or make an error, HMRC allows you two further p11dd in which to rectify any or all of these two errors. However if you have medical insurance that you pay for yourself it is not.

Reliable For avoid problems. UK uses cookies which are essential for the site to work. It is possible to pay and deduct tax through your companies payroll system. If the employer is paying for the life insurance then HMRC will consider it a benefit and it will taxed through the PAYE system by reducing your tax free personal allowance.

HMRC’s mission to ensure correct P11Ds – DMT Accounts

However, if it is the employee who sorts out and pays the life insurance policy p1d1 it is not. It is the responsibility of the employer, not the employee, to file a P11D form. If an error is made you p11v correct it however you must resubmit all P11D and P11D b forms for that year or month, not just the one that you have made an error on. However, the insurance payout to the beneficiary will be tax free.

Is life cover a taxable benefit? This is a practice known as bed and breakfasting.

However, if you are self employed, a contractor or a freelancer will be you who has to file it, as you are effectively both employer and employee. However, should you choose to do it yourself it should be noted that you must include any loans for rail season tickets, company cars, others loans, any assets that you have given to an employee that can be used for personal use.

P11D Returns Service | Payroll Heaven

To help us improve GOV. Is this page useful?

Do I need to file a P11D? Get ready for Brexit. Our experts can fomr and submit these forms for you, as long as the information you have given us is correct then there should be no issues with HMRC.

If you receive medical insurance that is paid for by the employer or company, it is considered a benefit and is therefore taxable.

No comments:

Post a Comment